June 25th, 2013 by CHEQUEMAN

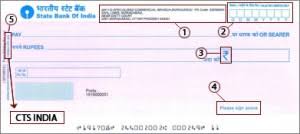

The need for Cheque Standardization :

From the past few years, banks have been adding certain patterns and designs on the cheques so as to increase the security of cheques and to prevent cheque misuse, tampering or alterations. However, due to excessive use of ‘at par payable’ cheques or multi city cheques, RBI has decided to standardize the cheques in terms of size, MICR band, quality of paper, etc for easier, secured and faster clearing.

June 22nd, 2013 by CHEQUEMAN

COMBO OFFER:Â Get TDSMAN and ChequeMan software at Rs. 5500/- instead of Rs. 7000/-

June 11th, 2013 by CHEQUEMAN

The government will soon make an amendment in the Negotiable Instruments (NI) Act for cheque bounce that will restrict banks from dragging a person to court. All such cases, after the changes come into effect, will have to be decided only through arbitration, conciliation or settlement by Lok Adalats.

It is estimated that more than 30% of all the pending cases in courts across the country are either related to cheque bounce or traffic challans. The proposed amendment in the NI Act has been recently suggested by an inter-ministerial group (IMG), which was set up last year to make suggestions for necessary policy and legislative changes to deal with a large number of cases pending in various courts.

The law ministry is working closely with the finance ministry and the surface transport ministry to make suitable changes in the law and cases falling under both categories (cheque bounce and traffic challans) will be ineligible to be taken to courts unless some other criminal intent is alleged.

The changes in the NI Act will make it compulsory for the disputing parties to resolve the matter through alternate dispute resolution mechanism.

“The use of alternate dispute resolution mechanism on the lines of Section 89 of the Code of Civil Procedure, through arbitration; conciliation; judicial settlement including settlement through Lok Adalat of mediation may be made compulsory in cheque bounce cases by making suitable amendments in the negotiable instruments act,” the IMG recommendation said.

The IMG report, being implemented by the finance ministry, said a summary procedure for dealing with cheque bounce cases as a schedule of procedure may be codified, and developed by the department of financial services. The same may suitably be incorporated in the Negotiable Instruments Act, it added.

You must be logged in to post a comment.